Introduction

Money management is no longer about keeping receipts in a folder or scribbling numbers in a notebook. In 2025, digital finance tools have taken over, making it easier than ever to stay on top of your income, expenses, and investments. One such platform leading the way is CashTrack com.

Whether you’re a student tracking your budget, a professional managing multiple income streams, or a small business owner juggling expenses, CashTrack com offers tools to simplify your financial life. This guide will explore how CashTrack com works, its features, real-life use cases, and why it could be the missing piece in your financial strategy.

What is CashTrack com?

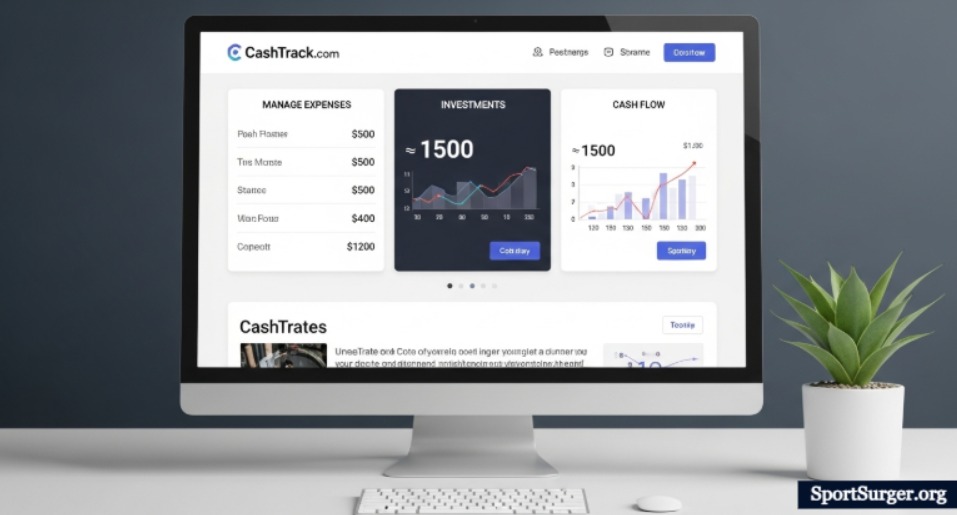

CashTrack com is an online financial management platform designed to help individuals and businesses track their cash flow. From monitoring daily expenses to analyzing investments, it provides a centralized dashboard where you can see your entire financial picture in real-time.

The goal is simple: make finance easy, transparent, and actionable.

Why Financial Tracking Matters in 2025

- Rising living costs: With inflation impacting households worldwide, expense tracking helps identify savings opportunities.

- Growing digital payments: Most people use multiple payment methods—credit cards, wallets, bank transfers—making manual tracking difficult.

- Investment diversification: Stocks, crypto, real estate, and savings accounts all need monitoring in one place.

That’s where CashTrack com comes in, offering an all-in-one platform for modern financial needs.

Key Features of CashTrack com

1. Expense Tracking

- Automatically categorizes spending into food, rent, utilities, subscriptions, etc.

- Provides monthly, weekly, or custom reports.

- Helps identify overspending patterns.

2. Income & Salary Management

- Tracks multiple income streams.

- Generates reports showing net savings after expenses.

3. Investment Monitoring

- Connects to brokerage accounts, crypto wallets, and mutual funds.

- Displays real-time investment performance.

4. Budget Planner

- Lets users set budget goals.

- Sends alerts when you’re nearing limits.

5. Cash Flow Forecast

- Predicts future financial standing using AI-based algorithms.

- Helps plan big purchases or investments.

6. Multi-Device Sync

- Access from desktop, tablet, or mobile.

- Secure cloud-based storage.

How to Use CashTrack com – A Step-by-Step Guide

Step 1: Sign Up

Visit the official site and create an account with your email or Google login.

Step 2: Add Financial Accounts

Connect your bank, credit cards, wallets, and investment accounts.

Step 3: Customize Categories

Set categories for personal or business expenses (food, rent, ads, tools, etc.).

Step 4: Set a Budget

Decide monthly limits for each category.

Step 5: Monitor Cash Flow

Check the dashboard daily or weekly for insights.

Step 6: Analyze Investments

Review performance charts for stocks, mutual funds, or crypto.

Benefits of Using CashTrack com

- Saves time by automating tracking.

- Reduces stress with clear financial visibility.

- Encourages savings and smart investments.

- Improves decision-making with accurate reports.

- Enhances financial literacy.

CashTrack com vs. Traditional Budgeting

| Feature | CashTrack com | Manual Budgeting |

| Automation | ✅ Yes | ❌ No |

| Real-time updates | ✅ Yes | ❌ No |

| Investment integration | ✅ Yes | ❌ No |

| Error-prone | ❌ Low | ✅ High |

| Time-saving | ✅ Fast | ❌ Slow |

Use Cases of CashTrack com

For Students

Track allowances, part-time income, and monthly expenses.

For Professionals

Manage salaries, side hustles, and tax planning.

For Small Businesses

Handle payroll, expenses, and profit margins.

For Investors

Monitor portfolio diversification and returns.

CashTrack com for Businesses

Businesses benefit by:

- Generating expense reports for tax filing.

- Managing cash flow across departments.

- Tracking employee reimbursements.

This makes it more than a personal finance tool—it’s also a business financial assistant.

CashTrack com Security Features

- Data encryption to protect sensitive information.

- Two-factor authentication (2FA).

- Bank-level security for all linked accounts.

- No third-party data sharing.

2025 Digital Finance Trends and CashTrack com

- AI-powered predictions help forecast future expenses.

- Cryptocurrency integration makes tracking digital assets easier.

- Multi-currency support for global users.

- Subscription tracking to avoid auto-renewal waste.

Common Problems CashTrack com Solves

- Losing track of small daily expenses.

- Missing bill payment deadlines.

- Overspending on lifestyle choices.

- Lack of visibility in investment performance.

- Difficulty managing multiple accounts.

Tips to Maximize CashTrack com

- Update your categories monthly.

- Review reports every weekend.

- Use alerts to avoid late payments.

- Track savings goals consistently.

- Pair it with financial literacy books for growth.

Future of CashTrack com

By 2026, CashTrack com aims to expand with:

- Deeper AI-driven insights.

- Integration with tax filing systems.

- More international banking partners.

- A dedicated app for businesses.

Conclusion

Managing money is not just about cutting costs; it’s about making smarter financial decisions. CashTrack com empowers users to track expenses, monitor investments, and forecast future cash flow in one place.

If you want financial peace of mind in 2025, adopting tools like CashTrack com is no longer optional—it’s essential.

FAQs

1. Is CashTrack com free to use?

Yes, it offers a free plan with essential features. Premium versions unlock advanced analytics and investment tools.

2. Can I link my bank account safely?

Absolutely. CashTrack com uses bank-level encryption and two-factor authentication for maximum security.

3. Does it support cryptocurrency tracking?

Yes, it supports popular crypto wallets and exchanges.

4. Can businesses use CashTrack com?

Yes, small businesses can manage payroll, expenses, and budgets with it.

5. How does CashTrack com compare to Excel budgeting?

It’s faster, automated, and more reliable than manual spreadsheets.